Key Takeaways:

- The upcoming Bitcoin halving, expected on April 20, will reduce miner rewards from 6.25 BTC to 3.125 BTC, potentially leading to a price increase due to the scarcity of new Bitcoin entering the market.

- The introduction of spot Bitcoin ETFs in the United States has significantly altered the supply-demand dynamic in favor of price appreciation, with these ETFs absorbing Bitcoins at a rate much higher than the new supply generated post-halving.

- Historical trends suggest a notable price surge in Bitcoin months after the halving event, as evidenced by the 430% increase observed five months post the May 2020 halving.

- The Bitcoin network’s health and security have improved, with a hashrate five times higher than during the last halving, making the network more secure against attacks and further decentralized geographically.

The upcoming Bitcoin halving event is stirring the crypto market with an intriguing twist, as the reduction in Bitcoin’s new supply is expected to intersect with burgeoning demand from spot Bitcoin Exchange-Traded Fund (ETF) issuers. According to a noted mining analyst, this dynamic is poised to initiate a “continuous, yet volatile upward grind” in Bitcoin’s price.

This halving, set against the backdrop of previous cycles in 2012, 2016, and 2020, is distinguished by the introduction of spot Bitcoin ETFs in the U.S., enhancing the supply-demand equation in favor of a more pronounced upward price trajectory.

Halving events, which slash Bitcoin miner rewards by half roughly every four years—or every 210,000 blocks—are fundamental to Bitcoin’s economic model. The forthcoming halving, anticipated on April 20 at block 840,000, will decrease mining rewards from 6.25 BTC to 3.125 BTC.

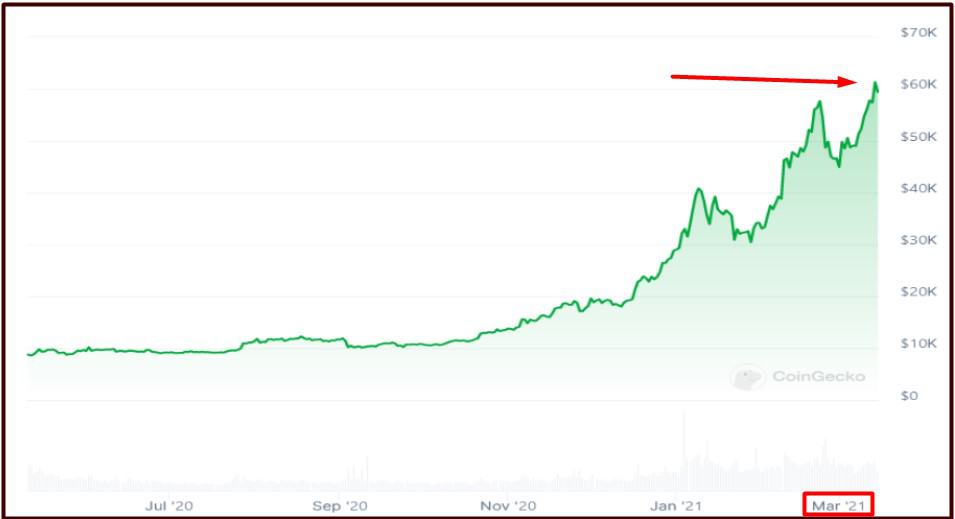

Historically, Bitcoin’s price has shown a tendency to ascend and surpass prior peaks approximately four to five months post-halving. Reflecting on the last halving on May 11, 2020, Bitcoin’s value catapulted from $8,750 to an impressive $61,300 by mid-March 2021, demolishing the previous high of $19,665 from December 16, 2017.

The emergence of spot Bitcoin ETFs is hailed as a pivotal factor altering Bitcoin’s supply-demand dynamics.

Matt Hougan highlighted the significant daily absorption of 2,450 BTC by spot Bitcoin ETFs against a backdrop of only 900 BTC being mined.

As I said on @SquawkCNBC this morning, the supply/demand dynamic in bitcoin right now is off-the-hook. pic.twitter.com/zWTmXLe1Uz

— Matt Hougan (@Matt_Hougan) February 29, 2024

Jaran Mellerud noted that post-halving, this discrepancy is expected to widen further with ETFs acquiring Bitcoin fivefold faster than the reduced mining output of 450 BTC, intensifying the supply-demand imbalance and fueling price growth.

During the last two months, the US spot #bitcoin ETFs have absorbed almost 3,000 BTC daily, which is more than 6 times the post-halving daily supply increase of 450 BTC.

— Jaran Mellerud 🟧⛏️🇳🇴 (@JMellerud) March 7, 2024

How can this supply-demand imbalance not lead to a massive, continuous #bitcoin price increase? https://t.co/Ja3uZL91Af

Further bolstering Bitcoin’s appeal is the network’s enhanced decentralization and security. Mellerud observed that Bitcoin’s hashrate—indicative of network health—is now quintuple what it was at the last halving, signaling a network so secure it’s deemed virtually impregnable.

Additionally, the geographical dispersion of mining activities from previously China-dominated regions to areas in Africa and Latin America exploiting lower electricity costs contributes to the network’s robust decentralization.

A fascinating trend to follow

— Alex Gladstein 🌋 ⚡ (@gladstein) February 7, 2024

Mining might decentralize away from the US towards dozens of countries in Africa, Latin America, the Middle East, and Asia, where many of the sites are off-grid, making the Bitcoin network much more robust https://t.co/ia6zxECEw9

In essence, the upcoming Bitcoin halving event is not merely a routine cycle but a groundbreaking juncture that could significantly reshape the financial landscape of Bitcoin, propelled by enhanced security measures, decentralization, and a novel supply-demand dynamic ushered in by the advent of spot Bitcoin ETFs.