Key Takeaways:

- U.S. prosecutors recommend 40-50 years prison sentence for Sam Bankman-Fried, the founder of FTX, on charges including fraud and conspiracy, emphasizing the severe impact of his actions on investors and the need for deterrence.

- The sentencing proposal includes over $11 billion in penalties and asset forfeiture, reflecting efforts to address the financial damages and campaign finance violations linked to Bankman-Fried’s activities.

- Comparisons are drawn to high-profile financial crimes, with the prosecution highlighting Bankman-Fried’s lack of remorse and cooperation in recovery efforts, alongside strategies to navigate FTX’s collapse.

In a significant development within the cryptocurrency world, U.S. legal authorities have put forward a recommendation for Sam Bankman-Fried, the founder and former CEO of FTX, a previously leading crypto exchange, to face 40-50 years in prison.

This recommendation comes as a consequence of his conviction on several charges, including fraud and conspiracy, all of which played a part in the downfall of FTX.

Bankman-Fried was accused of deceiving investors, circulating counterfeit documents, and illicitly channeling millions into the U.S. political system.

The Southern District of New York’s Department of Justice underscored the gravity of these actions in a sentencing memorandum, highlighting the need for a lengthy sentence of 40 to 50 years, in addition to proposing penalties exceeding $11 billion and asset forfeiture.

This move aims to reflect the severe impact of Bankman-Fried’s actions on thousands of victims and to deter similar financial misconduct in the future.

The document from prosecutors labeled their $11 billion penalty request as relatively conservative, pointing out that over a billion dollars had already been confiscated.

Efforts to recover funds have largely targeted political donations made by Bankman-Fried and other FTX executives during the U.S. elections, which are believed to constitute the most substantial campaign finance violation to date. Remarkably, 251 candidates have returned over $3 million of these funds.

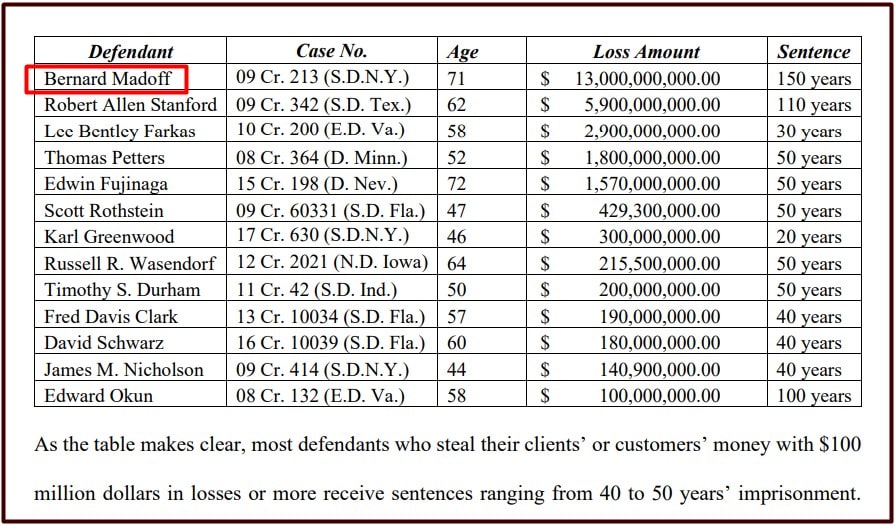

Prosecutors also drew parallels between Bankman-Fried’s case and other high-profile financial crimes, notably mentioning Bernie Madoff, who was implicated in a $13 billion fraud and received a 150-year sentence. The proposed forfeiture includes assets across various platforms and proceeds from significant share sales.

The memorandum didn’t shy away from illustrating Bankman-Fried’s perceived disregard for legal boundaries, supported by testimonies from former close associates. These testimonies accused him of engaging in bribery and exploiting his companies for illicit financial activities.

Despite his defense team’s plea for a more lenient six-year sentence, prosecutors dismissed it as grossly insufficient, emphasizing Bankman-Fried’s lack of cooperation in fund recovery efforts and the counterproductive nature of his actions post-FTX’s collapse.

Included in the prosecution’s submission were several exhibits, among them direct communications from FTX customers and documents that showcased Bankman-Fried’s strategies for navigating the aftermath of FTX’s bankruptcy. These ranged from deflective tactics to attempts at garnering public sympathy, painting a picture of a man who, according to prosecutors, chose to ignore societal norms and laws, driven by a dangerous sense of superiority and self-interest.