Key Takeaways:

- North Korea’s Lazarus Group has laundered $12 million through Tornado Cash, a crypto mixer, despite being under international sanctions.

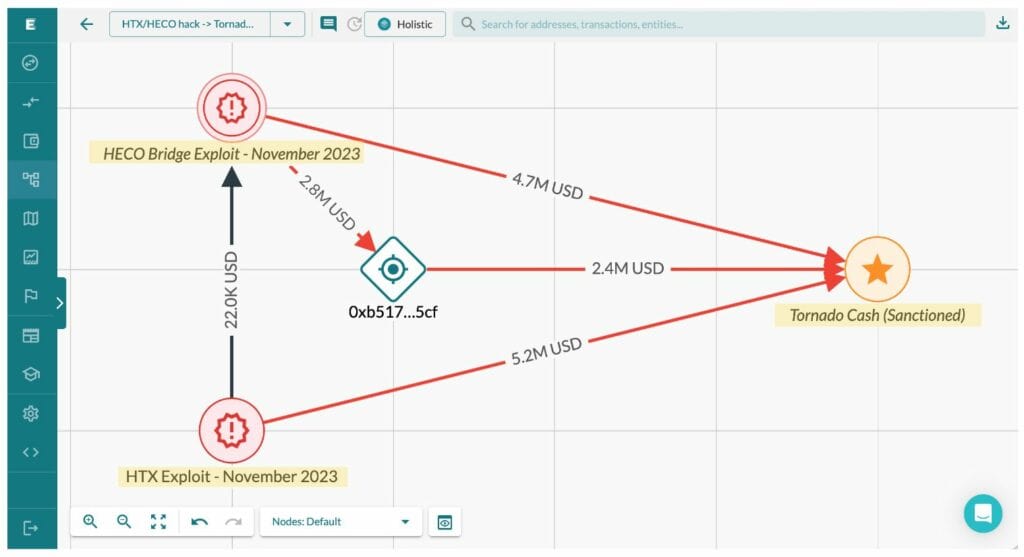

- The laundered funds originated from sophisticated hacks on the HTX exchange and its cross-chain bridge, HECO, in November, with a combined theft of over $116 million.

- Despite U.S. sanctions against Tornado Cash for facilitating over $1 billion in money laundering, its decentralized nature allows it to continue operations, challenging regulatory efforts to combat crypto laundering.

Despite facing international sanctions, North Korea’s notorious Lazarus Group has ingeniously navigated the complexities of the crypto world to launder a staggering $12 million.

This sum, derived from illicit activities, found its way through the murky waters of Tornado Cash, a crypto mixer that has itself been in the eye of regulatory storms.

NEW: 🇰🇵 North Korean hackers have laundered $12 million in $ETH through Tornado Cash over the last 24 hours

— BlockNews.com (@blocknewsdotcom) March 14, 2024

The journey of these ill-gotten gains began with a sophisticated attack on the cryptocurrency exchange HTX and its interconnected network, the HTX Eco Chain (HECO), back in November.

The assault resulted in a hefty haul of $30 million from HTX and an additional $86.6 million from HECO. The attackers didn’t rest on their laurels; they converted their booty into Ether through decentralized exchanges, laying low until now.

Tornado Cash, a platform that prides itself on decentralization and non-custodial privacy, became the final destination for this sizeable sum.

Built atop the Ethereum blockchain, Tornado Cash uses a blend of smart contracts to obscure the origins of cryptocurrency, allowing deposits from one address to be withdrawn by a completely different one.

This functionality has made it a haven for those seeking privacy but, simultaneously, a magnet for controversy due to its alleged role in laundering over $1 billion linked to various criminal activities, including those attributed to the Lazarus Group.

The U.S. Treasury Department’s sanctions in August 2022, aimed at curtailing Tornado Cash’s operations due to its purported facilitation of money laundering, have done little to stymie its utility to the Lazarus Group.

The sanctions’ effectiveness is hampered by the decentralized nature of blockchain technology, which ensures that Tornado Cash’s operations remain beyond the reach of traditional regulatory mechanisms.

This isn’t the first rodeo for the Lazarus Group in the world of crypto laundering.

With the recent crackdown on crypto mixers like Sindbad and Blender, the group has had to pivot back to old reliables like Tornado Cash.

These mixers, essential tools in the cybercriminal’s arsenal for obscuring the trail of digital currencies, have increasingly become targets of law enforcement agencies worldwide.

The ongoing battle between cybercriminals and regulators took a more personal turn with the legal actions against developers associated with Tornado Cash.

Charges have been leveled against key figures behind the mixer, highlighting the growing resolve of authorities to clamp down on the digital underbelly of crypto laundering.

Lazarus Group Moves $12 Million in Ether, Tornado Cash in Spotlight https://t.co/AHaKSFng22

— Crypto Mak (@crypto__mak) March 14, 2024

This saga serves as a stark reminder of the persistent vulnerabilities within the cryptocurrency ecosystem and the lengths to which groups like Lazarus will go to exploit them.

As the digital age advances, the cat-and-mouse game between cybercriminals and regulators continues to evolve, underscoring the need for robust, innovative solutions to safeguard the integrity of the crypto space.