Key Takeaways:

- BlackRock collaborates with Securitize to launch the BlackRock USD Institutional Digital Liquidity Fund, aiming at exploring asset tokenization and converting tangible assets into blockchain tokens.

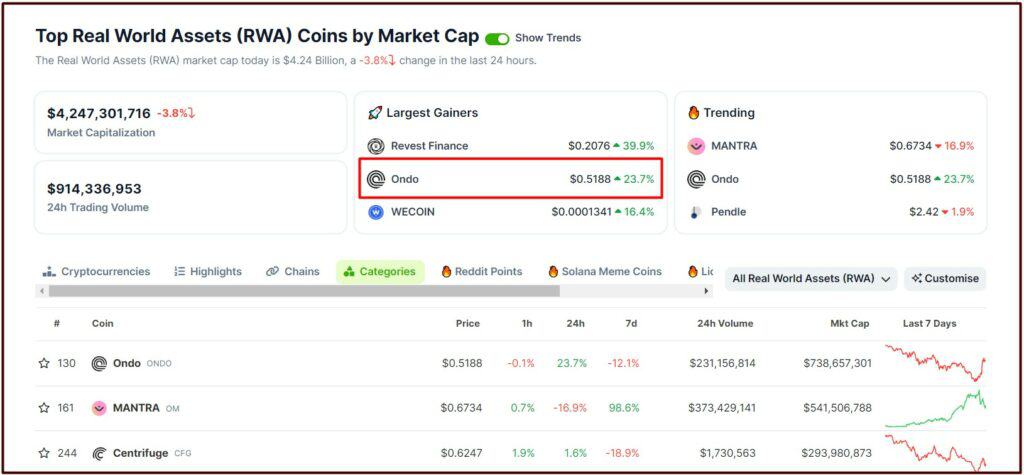

- The announcement led to a significant increase in Ondo Finance’s native token, ONDO, and speculation about a $100 million USDC stablecoin transaction as an initial investment in the fund.

- BlackRock’s efforts in launching ETFs for bitcoin and ether are foundational steps toward its broader goal of asset tokenization, aiming at creating more efficient and accessible markets by integrating traditional assets with digital innovations.

In a recent interview, Larry Fink, the CEO of BlackRock, highlighted the company’s efforts in launching exchange-traded funds (ETFs) for bitcoin and ether as foundational steps toward the broader goal of asset tokenization.

Investment powerhouse BlackRock has unveiled the BlackRock USD Institutional Digital Liquidity Fund, in a strategic move to explore the burgeoning field of asset tokenization. This initiative is a collaboration with Securitize, a key player in the asset tokenization sector, as detailed in a filing with the U.S. Securities and Exchange Commission.

Larry Fink's vision quickly becoming reality. $ETH pic.twitter.com/hLgOKceluN

— Altcoin Daily (@AltcoinDailyio) March 19, 2024

Although specifics about the fund’s holdings remain under wraps, Securitize’s involvement hints at a focus on converting tangible assets into blockchain tokens, a process known as real-world asset (RWA) tokenization.

The announcement has already made waves in the cryptocurrency market, with Ondo Finance’s native token, ONDO, seeing a significant uptick in value. This reaction underscores the market’s optimism about the potential impact of BlackRock’s venture into asset tokenization, a domain where Ondo Finance also operates.

Market analysts are buzzing about a notable blockchain transaction involving $100 million in USDC stablecoin, speculated to be an initial investment in the newly announced fund. This speculation remains unconfirmed, but it underscores the high stakes and keen interest surrounding BlackRock’s latest move.

BlackRock’s foray into digital asset funds is not new. The company successfully launched a bitcoin-based ETF earlier this year, attracting over $15 billion in assets. Additionally, BlackRock has been gearing up to introduce an ether-based ETF, reinforcing its commitment to integrating digital assets into mainstream investment strategies.

Larry Fink’s comments to CNBC in January about the ETFs being “stepping stones” toward tokenization highlight the company’s vision for the future of finance, where traditional assets and digital innovations converge for more efficient and accessible markets.

The tokenization of real-world assets represents a promising frontier at the intersection of digital assets and traditional finance.

By leveraging blockchain technology, this approach aims to streamline asset transactions, offering faster settlements and enhanced operational efficiency, signaling a transformative shift in how assets are managed and traded globally.